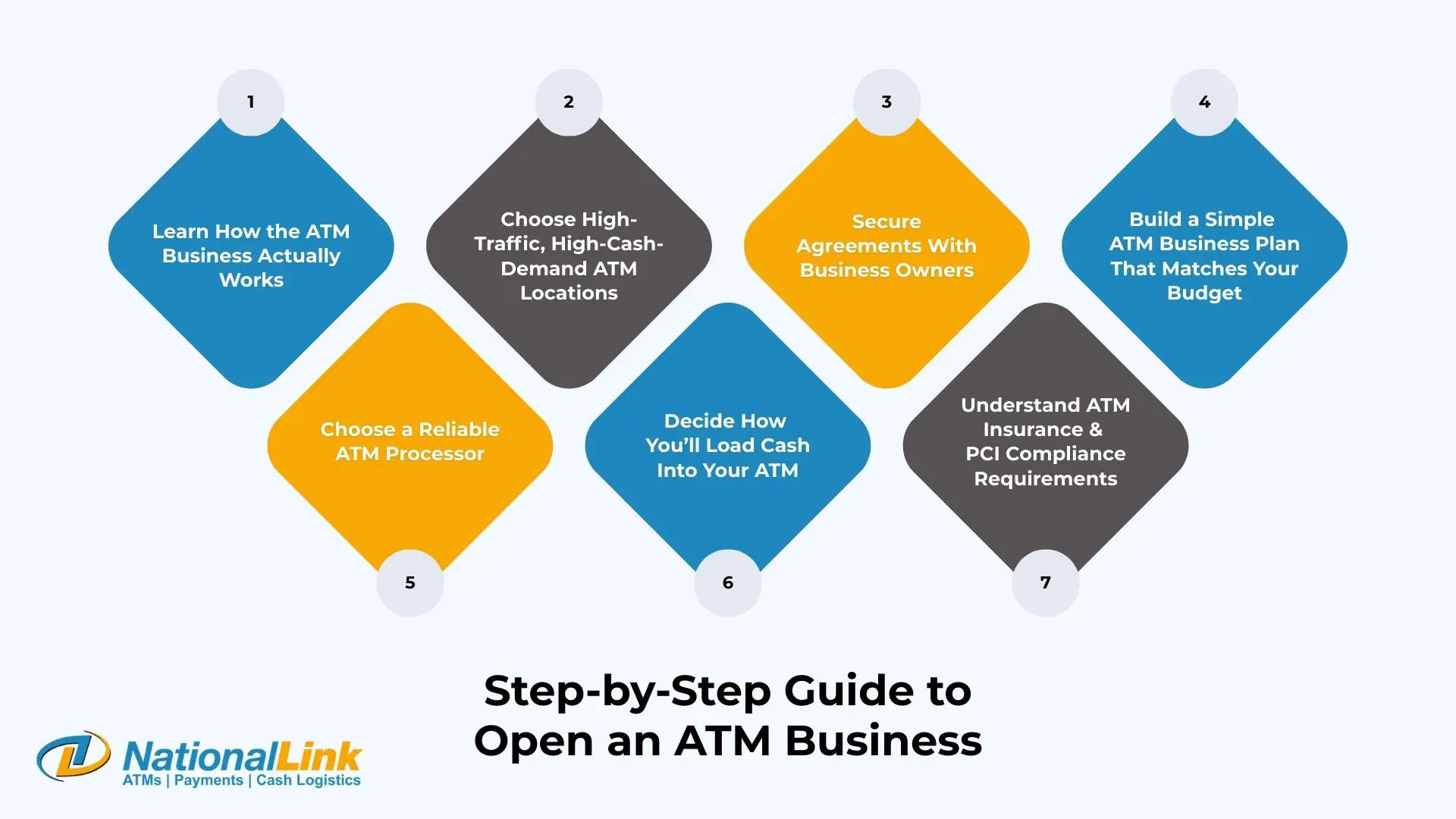

Step-by-Step Guide to Open an ATM Business

November 25, 2025 | by Mirela Gunawan

Suppose you’re looking for a low-maintenance, recession-proof side business (or full-time business) with real passive income potential. In that case, opening an ATM business is one of the smartest investments you can make.

Most people don’t realize this, but nearly half of all ATMs in the U.S. are owned by independent operators, not banks. These operators are called IADs (Independent ATM Deployers). They earn income every time someone withdraws cash from their machine.

And the best part?

- No employees

- No retail location required

- Low startup investment

- Flexible schedule

- Scalable into a full ATM route

What Is an ATM Business and How Does It Work?

An ATM business is a passive-income model where you own or host an ATM machine and earn money every time someone withdraws cash.

You make revenue from:

- Surcharge fees (average $2.50–$4.00 per withdrawal)

- Interchange revenue (paid by the cardholder’s bank)

- Increased foot traffic if the ATM is placed at your business

The ATM industry continues to grow due to cash-reliant businesses such as convenience stores, salons, nightclubs, gas stations, dispensaries, and small retailers. With low operating costs and predictable revenue, owning an ATM is one of the highest-ROI side businesses today.

- Low startup cost

- High profit margin

- Fast ROI (often 3–6 months)

- Passive income from every transaction

- Minimal maintenance

- Scalable (add more ATMs anytime)

If you’re ready to learn how to start an ATM business (and avoid the expensive mistakes beginners make), this guide walks you through everything step-by-step.

1. Learn How the ATM Business Actually Works (Before You Buy Anything)

Many new operators get excited and buy the cheapest ATM they can find online, only to discover later that it’s not compliant, not upgradeable, or not connected to the right processor.

Instead, start by understanding the basics:

How ATM Businesses Make Money

You earn a surcharge fee every time someone withdraws cash.

Typical surcharge: $2.50–$4.00 per withdrawal

Typical transactions: 150–300 per month in good locations

That’s $375–$900 per month per ATM, often higher in cash-heavy locations.

For a deeper breakdown of revenue, cash loading requirements, and ROI, read: How Do ATM Owners Get Paid?

Learn the Core Requirements of ATM Ownership

- How the machine connects to a processor

- Required bank accounts

- EMV + security compliance

- Contract terms to avoid

- Cash loading responsibilities

You don’t need a full course to start, but you DO need a real, reputable ATM partner (which is exactly what NationalLink is).

2. Choose High-Traffic, High-Cash-Demand ATM Locations

Location will make or break your ATM business.

A machine in a slow retail shop might earn $80/month.

A machine in a busy, cash-preferred location can earn $ 800 or more.

Best ATM locations with high monthly transactions

- Convenience stores

- Liquor stores

- Nail salons & barber shops

- Tattoo shops

- Restaurants & food courts

- Cafés

- Nightclubs & bars

- Gas stations

- Hotels

- Car washes

- Marijuana Dispensaries

- Event venues

- Strip Clubs

- Casinos

- Laundromats

Cash-only businesses are excellent locations for opening ATM machine business.

Think beyond typical retail

Some of the most profitable ATM placements today come from:

- Fairgrounds & festivals

- Pop-up events

- Flea markets

- Mobile food truck hubs

- Seasonal attractions

Mobile ATMs and ATM trailers perform extremely well at these temporary sites.

Your strongest resource: Can You Put an ATM Anywhere?

3. Secure Agreements With Business Owners (The Right Way)

Walking into a location and asking, “Would you like a free ATM that brings more foot traffic and reduces credit-card fees?” is often all it takes.

But before signing anything, check:

- Venue’s hours

- Safety & security (cameras, access, lighting)

- Foot traffic during peak hours

- Cash-preferred customer base

- Availability of a stable internet connection

Pro tip: Always offer the business owner a revenue share. It helps secure long-term relationships.

4. Build a Simple ATM Business Plan That Matches Your Budget

You don’t need a 20-page document. You just need clarity on:

Startup Costs

- ATM machine: $2,300–$4,000

- Cash to load machine: $1,000–$8,000, depending on location

- Processing fees: usually $0 with NationalLink

- Internet/WiFi or wireless modem: $10–$20/month

Total cost to start: $3,000–$5,000 on average.

Funding Options

You can fund your first machine using:

- Personal savings

- 0% APR intro credit card

- Financing through your ATM vendor

- Business credit line

Your ATM pays for itself quickly in a good placement.

5. Choose a Reliable ATM Processor (One of the Most Important Decisions)

Your ATM processor handles:

- All transactions

- Network connections

- EMV compliance

- Reporting

- Settlements

- Support

A bad processor = slow payments, poor support, and potential compliance headaches.

A great processor (like NationalLink) =

- Same-day funding

- No hidden monthly fees

- Real-time reporting

- Reliable uptime

- Support from an established ISO

- Predictive cash management

- PCI compliance and EMV security

- 24/7 monitoring + customer support

- Cash insurance & armored services (optional)

Before choosing a processor, read: Choosing an ATM Processor: What IADs Need to Know

6. Decide How You’ll Load Cash Into Your ATM (Vaulting Options)

There are 2 ways to load cash into your ATM (otherwise known as Vaulting):

Option 1: Self-Loading (You Refill Your Own ATM)

Best for small businesses or side-hustlers who want to keep 100% of profits.

You typically:

- Refill during off-peak hours

- Use lockable PCI-compliant cassettes

- Keep the process discreet

- Maintain surveillance for safety

Option 2: Professional Cash Loading (Armored Vault Cash Services)

If you prefer full outsourcing, NationalLink offers a Vault Cash & Armored Service Program that handles everything:

- Armored trucks deliver and load cash

- Cash is insured

- Predictive cash forecasting ensures you never empty out

- Reconciliation + reports included

- PCI-level security standards maintained

- Real-time activity monitoring

This option is ideal for high-traffic ATMs or owners who don’t want the responsibility of handling cash.

Step-by-Step: How Professionals Refill an ATM

- Forecast cash needs using transaction data

- Secure cash preparation from a partner funding bank

- Armored transport from a secure vault

- Cash loading into PCI-approved cassettes

- Reconciliation & reporting

- Test withdrawal & security checks

Everything is insured, monitored, and documented.

→ For more details: Who Fills Money In ATM Machines

7. Understand ATM Insurance & PCI Compliance Requirements

You don’t need expensive “ATM insurance” to operate safely.

Instead, your main protections are:

- Choosing a secure, camera-monitored location

- Installing ADA & EMV-compliant equipment

- Having a standard business liability policy

- Ensuring the business owner has property insurance

Full ATM theft is extremely rare, but physical damage can still occur so choose your locations wisely.

Maintain PCI Compliance

PCI DSS compliance ensures cardholder data is protected. ATM owners must:

- Use a PCI-compliant processor

- Maintain updated software

- Use encrypted PIN pads

- Complete regular security updates

- Reduce card-present fraud using EMV readers

NationalLink handles PCI compliance for all machines we install, ensuring secure transaction processing.

Simple roadmap for you:

- Learn the basics

- Pick strong locations

- Secure agreements

- Plan your startup costs

- Choose a trusted processor

- Decide how to vault your ATM

- Keep your machine safe and compliant

And with the right partner, you’re not doing it alone.

Ready to Start Your ATM Business?

NationalLink has helped thousands of new ATM owners start and scale their ATM routes with:

- EMV-ready ATM machines

- Same-day funding

- Full processing support

- Live US-based customer service

- Reliable reporting tools

- Partnerships with top brands & banks

Contact NationalLink today to get a free consultation and learn how to open your ATM business today.

Related Posts